Insurer sees surge of ship accidents on horizon as pandemic puts squeeze on safety measures

27 July 2020

Worldwide shipping losses have declined by almost 70% over the past decade – but the economic impact of the coronavirus pandemic could reverse these positive safety trends, a new report has warned. Andrew Linington reports

In its latest annual Safety & Shipping Review, the insurance firm Allianz Global Corporate & Specialty (AGCS) suggests that a damaging combination of economic downturn, cost-cutting measures, fatigued crew and weakened emergency response could see a surge of accidents at sea.

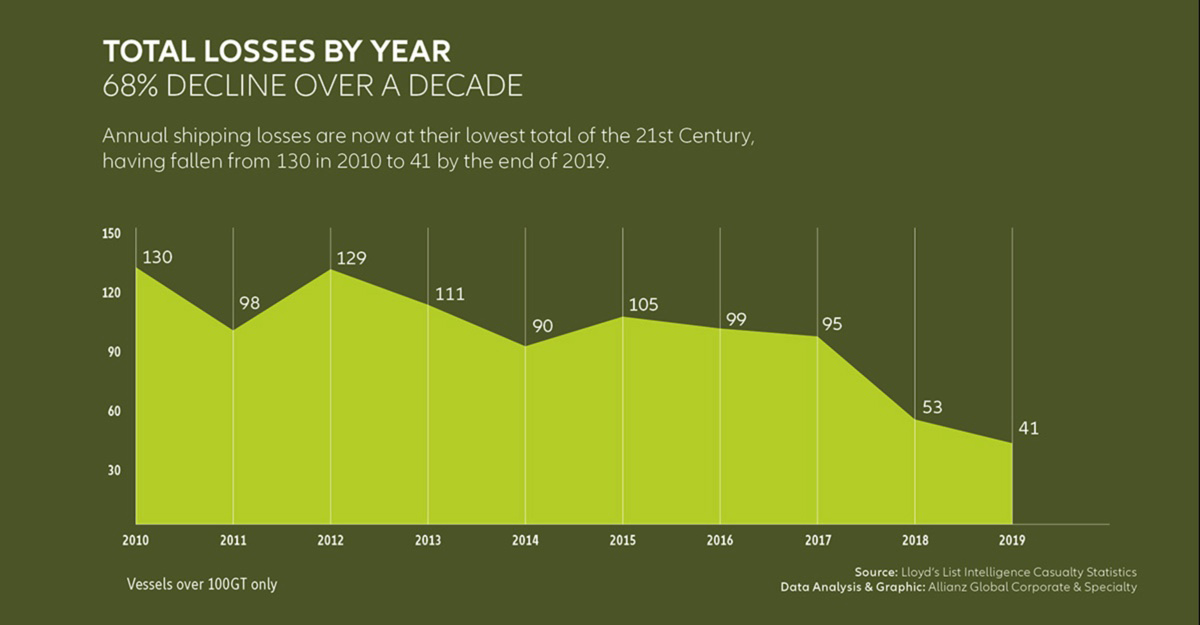

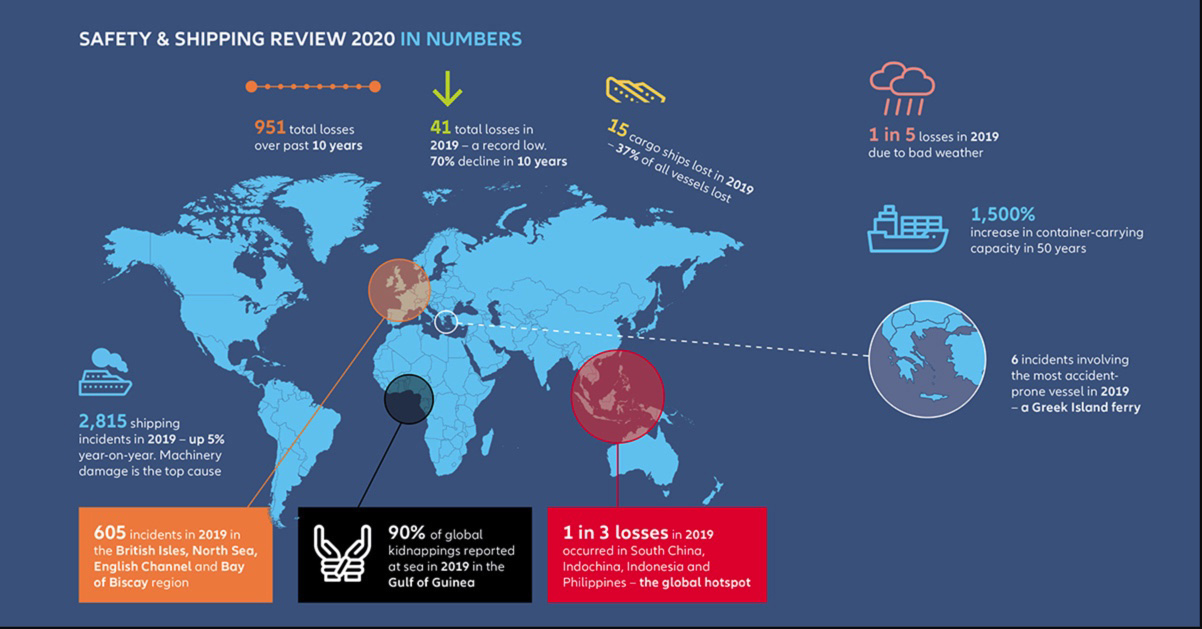

Ship losses fell by more than 20% year-on-year during 2019, to a record low of just 41 vessels of 100gt and above, compared with 130 in 2010. However, AGCS cautioned, the number of shipping casualties or incidents rose by 5%, to 2,815, with more than one-third of these related to machinery damage or failure.

Waters around the British Isles, North Sea, English Channel and the Bay of Biscay replaced the East Mediterranean to become the main hotspot, accounting for one in five incidents during 2019.

AGCS said the coronavirus pandemic has already resulted in a sharp reduction in global seaborne trade and warned that the economic fallout could unwind years of safety gains.

Top 10 problem areas

The report highlights 10 key causes of concern – including the way in which the inability to change crews is impacting their welfare and raising the risks of 'human error' accidents – and AGCS says the industry needs to adopt measures to reduce crew-related problems.

'Adjustments in work and rest hours offer effective means of fatigue management, while incentives in cash or kind will also have a positive impact on crew wellbeing,' senior marine risk consultant Captain Nitin Chopra said.

'Hiring from the pool of locally available seafarers may be an option in some cases that can be further facilitated by cooperation among crew management companies.'

AGCS global head of marine risk consulting Captain Rahul Khanna warned: 'Shipowners will face additional cost pressures from a downturn in trade and will no doubt put efficiency measures in place. We know from past downturns that crew and maintenance budgets are among the first areas that are cut. But it is important that safety and maintenance standards are not impacted by the downturn.'

AGCS is particularly concerned that machinery failures – already the most common cause of incidents – could increase even further as a result of the pandemic.

'Disruption in supply of spare parts and essential consumables like lube-oil and hydraulic oils can delay scheduled maintenance or result in crews using alternative grades or brands. At the same time, travel restrictions may affect the ability of specialist engineers to access ships to make repairs.

'The current situation is making it difficult for vessels to obtain essential spares and consumables and carry out maintenance and repairs. This could have a detrimental effect on the safe operation of engines and machinery and potentially cause damage or breakdown, which in turn can lead to groundings or collisions.'

AGCS is alarmed at the prospect of surveys and inspections being reduced or delayed as a result of staff shortages or social distancing measures, and Capt Khanna said there are also concerns about the potentially damaging impact of coronavirus on the effectiveness of emergency rescue and support services.

Shipping is increasingly exposed to risks arising from geopolitical instability, national rivalries, failed states and the continued prevalence of piracy. Shipping will increasingly be drawn into geopolitical disputes Senior marine risk consultant Captain Andrew Kinsey

Cruise on the brink

The state of the cruise industry was particularly disturbing, with 95% of the world fleet in lay-up in April.

'The cruiseship industry will survive the coronavirus crisis. But when it does return, it will be operating in a very different world,' AGCS head of marine hull and liabilities Chris Turberville said. 'The problem of infectious diseases is not about to go away and vessels will need to operate with much more stringent levels of protections for outbreaks than in the past.'

There are also concerns about the accumulation of risk created by the huge value of the large number of cruiseships and tankers currently laid-up in typhoon and hurricane-prone waters.

The monthly cost of cruiseship lay-up can be between US$1m-$3m, and the industry faces 'a real test' in maintaining vessels to that they emerge from lay-up in reasonable condition and with quality crew.

AGCS data for 2019 shows that cargo ships accounted for more than one third of vessels lost during the year, and that foundering was the main cause of total losses – no fewer than three in every four.

Contributing factors included bad weather, flooding and water ingress, engine trouble and vessels capsizing.

Car carrier and ro-ro vessel safety concerns were also raised. Total losses involving ro-ros were up year-on-year in 2019, as well as smaller incidents (up by 20%) – and the trend is continuing through 2020, AGCS warns.

'The rise in number and severity of claims on ro-ro vessels is concerning. Ro-ros can be more exposed to fire and stability issues than other vessels. Many have quick turnarounds in port and a number of accident investigations have revealed that pre-sail away stability checks were either not carried out as required or were based on inaccurate cargo information. Too many times commercial considerations have endangered vessels and crews and it is vital that this is addressed on shore and onboard,' Capt Khanna said.

Supersized containerships

There were almost 200 reported fires on vessels over the past year, up 13% and resulting in five total losses in 2019 alone. Mis-declared cargo is a major cause, with particular problems in the container sector – where evidence suggests that the majority of containers have issues with mis-declared or improperly stowed cargo. Chemicals and batteries are increasingly shipped in containers, and these pose a serious fire risk if they are mis-declared or wrongly stowed, and measures to reduce these risks are vital, as the threat will increase as ships continue to become bigger and the range of goods transported grows.

Regulations have failed to keep pace with the 'super-sizing' of containerships and the challenge of fighting larger and more dangerous fires. 'The size of containerships has increased exponentially over the past 50 years. Vessels have almost tripled in size, while capacity has increased from around 1,500TEU in 1970 to more than 24,000TEU today. In contrast, crew numbers have decreased by around a quarter while the average number of fire-fighting hoses has only increased from one to two.'

Regulatory modernisation is urgently needed and the International Maritime Organization (IMO) should adopt industry proposals for amendments to the SOLAS Convention, including improvements in the detection and control of fires.

AGCS predicts that there will be more losses linked to the sulphur cap in the months ahead. It is already closely monitoring claims to assess evidence of technical and operational problems with scrubbers, and warn that there have been incidents resulting from scrubber design flaws and issues with their manufacture, testing and installation.

The report highlights particular concerns about the corrosive effects of scrubber waste causing wastewater to flood enginerooms, ballast tanks and cargo holds, and it also warns that blended low sulphur fuels often carry an increased risk of cat fines, which can damage engines.

'Fuels from different ports and refineries currently have varying properties, which could result in damage to engines and essential equipment.'

Technology risks

AGCS also cautioned about 'significant' technology-related risks, noting reports that there has been a 400% increase in attempted cyber-attacks in the maritime sector since the pandemic began, as well as a marked rise in GPS spoofing attacks on ships, particularly in the Middle East and China.

'The way in which vessels and crew are interacting with technology has become a significant factor in collisions and groundings,' AGCS said, highlighting two UK accident investigations in which over-reliance on, and mis-interpretation of, AIS and ECDIS data were key contributory factors.

Better training and utilisation of data could help improve safety. 'The industry needs to start learning from successful journeys, not just accidents. Such insights can be used to develop new technology, inform training and improve crew and safety culture.'

Increasing the use of industrial control systems to monitor and maintain engines could also play a major role in reducing machinery breakdown incidents, one of the biggest causes of marine insurance claims.

Onshore monitoring of engines, together with predictive or preventative maintenance is likely to improve reliability, reduce machinery breakdown incidents and cut the incidence of human error, enabling a better understanding of the root cause of machinery breakdown incidents.

Shipping is increasingly exposed to risks arising from geopolitical instability, national rivalries, failed states and the continued prevalence of piracy. Shipping companies should prepare for an increase in disruption to supply chains and their operations, senior marine risk consultant Captain Andrew Kinsey warned.

'Shipping is a global commodity and can be used as a pawn in disputes due to its impact on the economy,' he said. 'If you disrupt supply chains there can be a direct impact on global markets. Shipping will increasingly be drawn into geopolitical disputes.'

Tags

More articles

Giving a voice to the needs of maritime professionals on training

MAIB questions IMO cargo misdeclarations measures following Ever Smart investigation

Concerns over the effectiveness of International Maritime Organization (IMO) measures to tackle the dangers posed by misdeclared and overloaded containers have been raised by the UK Marine Accident Investigation Branch (MAIB).

Fatal fall on Dutch cargoship highlights risks of working alone

Dutch safety officials have warned seafarers of the risks of working alone following an investigation into a fatal accident onboard a general cargoship.