A survey of UK members of Nautilus has revealed that up to 11,000 seafarers could be without financial support because their employer does not operate UK PAYE for tax and national insurance purposes.

As such their jobs cannot be protected under the Coronavirus Job Retention Scheme (JRS) nor will they receive grants to cover lost income under the self-employed scheme.

Some face a triple whammy because they can't work, cannot claim the same financial support as other UK workers, and face an unexpected tax bill.

Nautilus recently conducted a survey of the employment status of our UK seafarer members.

The information provided by our members has been passed on to the government and is being used in our discussions with them around providing additional support for UK seafarers at this difficult time.

The full survey results are below:

Survey method

The Nautilus survey was sent to 8,774 full members excluding shore-based members and officer trainees.

This represents 75% of the total of Merchant Navy officers active at sea according to the Department for Transport (Seafarer statistics 2019).

Nautilus received 1,194 completed questionnaires, a return of 14%.

Representation

Key highlights in terms of representativeness of the responses are:

- 94% of the responses were from men and 5% from women

- 29% were engineer officers inc. Chief Engineers

- 25% were deck officers

- 22% were shipmasters

- 2% ratings

The age profile of those responding to the survey:

- 26% aged between 55-64

- 23% aged between 35-44

- 23% aged between 25-34

- 18% aged between 45-54

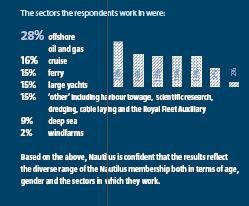

The sectors the respondents work in were:

- 28% work in the offshore oil and gas

- 16% in cruise

- 15% ferry

- 15% large yachts

- 9% deep sea

- 2% windfarms

- 15% “other” including a wide ranging including, harbour towage, scientific research, dredging, cable laying and the Royal Fleet Auxiliary

Based on the above Nautilus is confident that the results reflect the diverse range of the Nautilus membership both in terms of age, gender and the sectors in which they work.

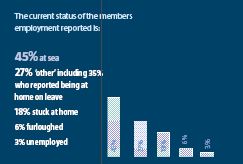

The current status of the members employment reported is:

- 45% at sea

- 18% stuck at home

- 6% furloughed

- 3% unemployed

- 27% 'other' including 35% of whom report being at home on leave

Survey highlights

Highlights of the survey include:

Ninety-five percent (95%) of those responding considered themselves to be employees with 81% reporting a permanent contract, 19% were either on voyage based or fixed term contracts. Fifty-nine percent (59%) join their vessels outside the UK.

Of those serving on fixed term contracts 42% reported they had expired, with 28% expiring before 28th February, 9% expired between 28th February and 19th March. 3% expired after 19th March and 3% expired between 19th March and the date of the survey (30th April). Fifty eight percent were on fixed contracts that were still in force.

Fifty-two percent (52%) report that their employer is based overseas. Forty-eight percent (48%) reported that their employer did not operate PAYE. Employers were based in Channel Islands (33%), UK (19%), Singapore (15%), Bermuda (7%) and Cayman Islands (3%). Over 25 other jurisdictions from Brazil to Indonesia were also reported.

Fifty-eight percent (58%) report that they have contracts subject to UK jurisdiction and the remainder report a diverse range of jurisdictions including 20% within the Red Ensign Group (including the Cayman Islands, Isle of Man, Bermuda and Channel Islands), 7% in Singapore, 3% in Bahamas, 2% in Cyprus and 2% in Malta.

Seventy-nine percent (79%) live in the UK and 81% pay UK income tax. Sixty-four percent (64%) made a self-assessment for income tax purposes and 65% maintain national insurance (NI) contributions. The majority pay NI Class 1 (60%, 30% Class 2 and 10% Class 3.

Ninety-five percent (95%) have earned money from their employer in the current tax year and 42% are concerned that they will be unable to claim SED for 2019/20.

Only 1% have made a claim for Universal Credit.

Nautilus would like to thank Seatax Ltd and SK Tax Service for their help with this article. Members can contact them for specialist tax advice and support: visit www.seatax.ltd.uk or sktax.co.uk

Seafarers Earnings Deduction (SED)

Seafarers have special employment, tax and national insurance status that they occupy because of the nature of their work in an industry that faces intense competition on a global basis. Over the years the government has introduced positive measures to assist the shipping industry in retaining British seafarers.

In terms of income tax, Seafarers Earnings Deduction (SED) is a section of UK tax legislation that grants qualifying seafarers the right to claim 100% tax exemption on foreign earnings.

Originally introduced in 1977 as the Foreign Earnings Deduction (FED), it concerned the taxation of earnings from work undertaken abroad. It was initially available to any UK resident who routinely spent time working abroad. but in 1988 it was restricted to seafarers.

In 1991, following a series of problems in securing sufficient UK ships and seafarers to transport military equipment to the Gulf after Iraq invaded Kuwait, the Finance Act brought in further improvements to the tax rules for seafarers, effectively doubling the period (to 183 days) that seafarers were able to spend in the UK. Announcing the decision in the House of Commons, the Chancellor of the day Norman Lamont stated: 'The Gulf hostilities have reminded us of the important contribution which our Merchant Navy can make to our defence. I recognise that there is a strategic case for measures to encourage shipping companies to draw their crews from seamen in the UK who would be willing and able to serve in time of war.'

The new '183–day rule' was warmly welcomed by all sides of the industry as a useful measure that would help to safeguard the employment and training of British seafarers and bring the UK seafarer tax regime into line with most other major maritime nations. In 2006 FED was renamed Seafarers Earnings Deduction, to reflect the fact that it applied only to seafarers.

National Insurance contributions

With regard to National Insurance (NI), a UK resident seafarer not in PAYE employment must first make an application to HMRC in order for their income and its source to be assessed, thereby determining the NI contribution level required, i.e. Class 1, 2 and/or 3. This is because the predominant model of employment for UK seafarers is through offshore agents of UK based shipowners, set up with government support to assist UK shipowners to stay competitive by avoiding employer NI contributions. This means that UK seafarers are employed on offshore employment contracts in overseas jurisdictions such as Bermuda, Cayman Islands, Gibraltar, Jersey and Guernsey.

If, following assessment of an application, there is found to be no Class 1 (employed) liability, HMRC will invite the seafarer to pay on a voluntary basis at the same rate as people living and working abroad, a concessionary rate Class 2 contribution whilst employed, and voluntary Class 3 rate when unemployed.

In making these rates of National Insurance contributions available, HMRC has extended the opportunity to seafarers (mariners) to secure their entitlement to a State Pension (subject to contribution criteria) together with other State benefits e.g. Contribution-based Employment and Support Allowance.

Maritime advice resources

• Seafarers' Advice & Information service (SAIL), which offers information on financial and other support specifically for seafarers

• You can also call SAIL on 0800 160 1842. SAIL can help you find appropriate support from a variety of sources and even grants from the Seafarers Hospital Society with whom we work closely to support our members.

• You can find information about what to do if your work has been affected by the lockdown on our Coronavirus resources hub

• If you have a question about your specific workplace or company then please contact your industrial organiser. Members can find their contact details by logging in to My Nautilus.

Tags

More articles

British seafarers falling through Government's Covid-19 financial support net

Thousands of British seafarers are at risk of falling through gaps in the government's Covid-19 financial support schemes, Nautilus has warned.

Still serving seafarers – an ITF inspector adapts to life under the Covid-19 pandemic

A coordinated effort by Swedish officials successfully enables crew change in Barcelona as European border restrictions put brakes on freedom of travel

US yacht partner commits to professionalism and welfare

Keeping the lifelines open – what it's like to work on essential island ferry services during the Covid-19 pandemic

Working with charities: focus on crew wellness at ISWAN SeafarerHelp

Nautilus flags financial help available to furloughed seafarers

Financial support is available to furloughed crew from several Nautilus partner maritime charities.